Unearned Revenue Journal Entry

The accounting equation Assets Liabilities Owners Equity means that the total assets of the business are always equal to the total liabilities plus the total equity of the business. Company may use a different account name but as long as it is under current liability it will be fine.

What Is Unearned Revenue Quickbooks Canada

In certain types of business transactions it is a requirement for the customer to pay a part of the total amount or the entire sum in advance for example security deposit to rent a property customized items bulk orders insurance premium etc.

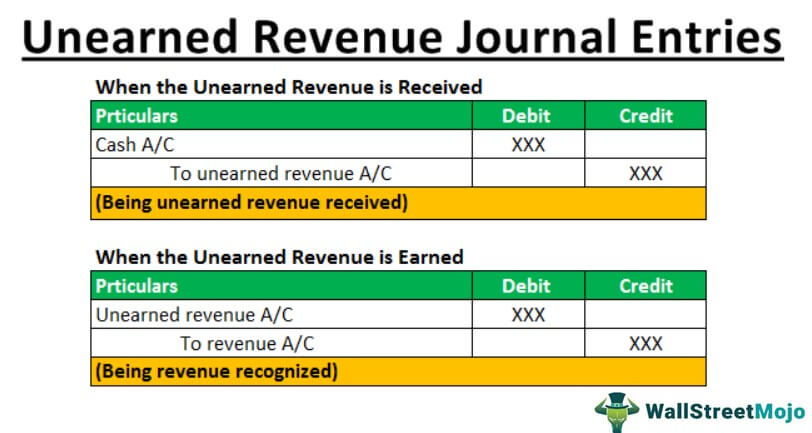

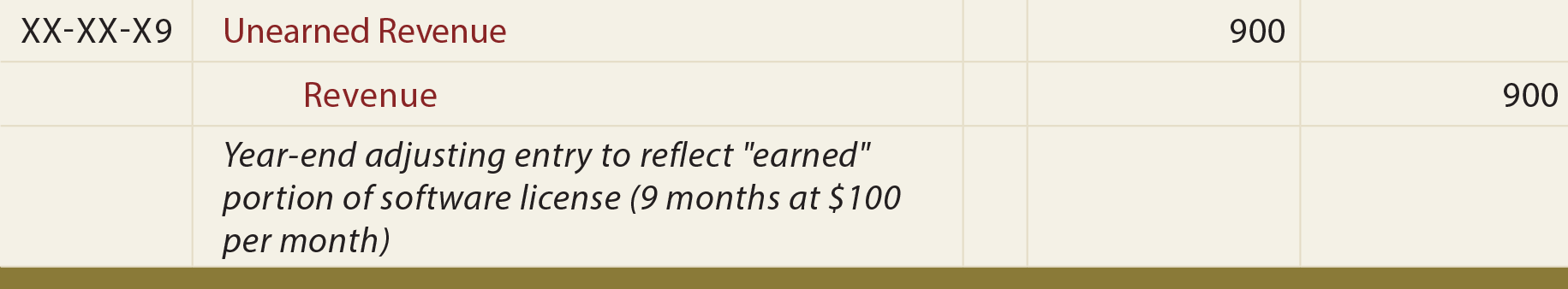

. At the end of the month the owner debits unearned revenue 400 and credits revenue 400. Unearned Revenue Journal Entry Examples. There are two ways of recording unearned revenue.

Unearned revenue is money received by an individual or company for a service or product that has yet to be fulfilled. Journal Entry of Deferred Revenue. The owner then decides to record the accrued revenue earned on a monthly basis.

The adjusting entry for unearned revenue depends upon the journal entry made when it was initially recorded. Remember that income is not the assets ie. A contingent liability is a potential liability that may occur depending on the outcome of an uncertain future event.

An adjusting journal entry is usually made at the end of an accounting period to recognize an income or expense in the period that it is incurred. The business owner enters 1200 as a debit to cash and 1200 as a credit to unearned revenue. As a result journal entry for advance received from a customer is.

On 1 st April a customer paid 5000 for installation services which will render in the next five months. On January 31 2019 and each month thereafter the entity would record the following journal entry. On 30 Apr as the work already completed they need to record revenue to make sure it meets the matching principle.

When the company delivers goods or services to customers it is time to record revenue. Deferred revenue is a liability account that represents the obligation that the company owes to its customer when it receives the money in advance. A few examples of unearned revenue journal entries are stated below.

Payments in excess of billings. Deferred revenue journal entry. Remember in accounting we dont just list income as the account instead we list the exact type of income that took place which in this case is services rendered.

Cash you get from for example rendering servicesIt is the event itself the rendering of the service that results in cash coming in immediately or. This is true at any time and applies to each transaction. A contingent liability is recorded in the accounting.

For deferred revenue the cash received is usually reported with an unearned revenue account which is a liability to record the goods or services owed to customers. The amount received would be recorded as boos unearned income Unearned Income Unearned income refers to any additional earnings made. When the payment is cleared it is recorded as an adjusting entry to the asset account for accrued revenue.

The company records revenue into the income statement by using unbilled revenue. It also increases the customer deposit which is the current liabilities on balance sheet. Commonly referred to as deferred revenue or unearned revenue.

Presentation of accrued revenue in financial statements. Unearned revenue can be thought of as a prepayment for goods or services. For this transaction the accounting equation is shown in the following table.

Likewise after the company delivers goods or performs services it can make the journal entry to transfer the deferred revenue to revenue. The earned revenue is recognized with an adjusting journal entry called an accrual. Accrued revenue is shown as adjusting journal entries under the current assets category in the balance sheet and as an earned revenue in the income statement of the company.

Journal Entry for Advance Received from a Customer. These entries are typically made to record accrued income accrued expenses unearned revenue and prepaid expenses. The journal entry will increase cash on balance sheet.

The adjusting entry for unearned revenue will depend upon the original journal entry whether it was recorded using the liability method or income method. In simple terms Deferred Revenue Deferred Revenue Deferred Revenue also known as Unearned Income is the advance payment that a Company receives for goods or services that are to be provided in the future. 267 267 Revenue.

The following Deferred Revenue Journal Entry outlines the most common journal entries in Accounting. The company makes journal entry by debiting unbilled receivable and credit unbilled revenue 5000. Accounting Equation for Unearned Revenue Journal Entry.

1 the liability method. A properly documented journal entry consists of the correct date amounts to be debited and credited description of the transaction and a unique reference number. On January 1 2020 a payment of 4000 is received.

What Is The Adjusting Entry For Unearned Revenue Youtube

Unearned Revenue Definition Explanation Journal Entries And Examples Accounting For Management

Unearned Revenue Journal Entries How To Record

Unearned Revenue Collect And Adjust Principlesofaccounting Com

Unearned Revenue Journal Entry Double Entry Bookkeeping

What Is Unearned Revenue Quickbooks Canada

0 Response to "Unearned Revenue Journal Entry"

Post a Comment